Mortgage REITs manage portfolios made of residential mortgage backed securities on real estate. Within the world of residential mortgage REITs, there are two primary types: those holding RMBSs insured by federal agencies and those that own such RMBSs without any such agency insurance. Agency mortgage REITs have portfolios composed exclusively of residential mortgage backed securities, or similar paper, insured by federal agencies. Because government agencies underwrite the mortgages and issue the RMBSs, the paper comes with an agency backing and an implied U.S. government backing.

Though numerous borrowers defaulted over the years, and more continue to default as time rolls on, the agencies continue to pay and/or buy out defaulting obligations, and the government continues to fund the operation. Prepayment buying of defaulting mortgages often has a volatile and unpredictable affect upon a mREIT's quarterly income, yield, asset valuation and the spread or margin that the mREIT will get. Nonetheless, prepayment is considerably preferable to an actual default, and this difference is why agency REITs became so popular.

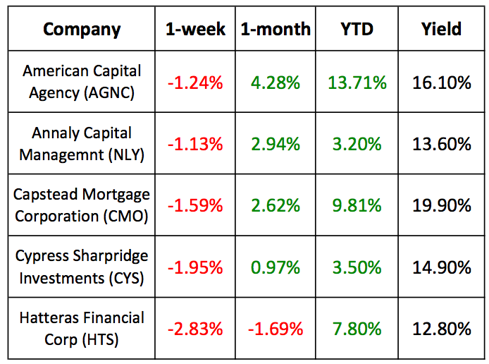

Below, I have provided recent performance rates for five reasonably liquid and high yielding Agency Mortgage REITs: American Capital Agency Corp. (AGNC), Annaly Capital Management, Inc. (NLY), Capstead Mortgage Corp (CMO), Cypress Sharpridge Investments (CYS), and Hatteras Financial Corp (HTS). I have provided one-week, one-month and 2012-to-date equity performance rates, as well as each REIT's yield.

(click to enlarge)

Last week, most agency mREITs declined along with many other high-yield securities, as investors flooded into higher rated paper. In theory, this created a dislocation between agency mREIT prices and agency RMBS. On Monday, though, all of the above-mentioned mREITs appreciated by at least twice as much as the Barclays high yield bond fund (JNK). See the 1-day comparison chart, below:

(click to enlarge)

One key concern that may affect these agency mREITs is that rising interest rates will some day hurt the assets held by these mREITs. Since the industry standard is to leverage assets in order to multiply the return, that leverage risk does at a credit variable. If rates rise, then the book value of assets may have similarly multiplied losses.

If these mREITs do not effectively hedge or curb leverage usage, this risk may soon become a significant concern. Agency mREITs now have leverage rates between five and nine times their asset valuations, and most have been increasing their leverage over time and so far in 2012. Some may report increased leverage taken during the second quarter and/or secondary offerings after dividends, next month.

If interest rates do spike up, leveraged agency mREITs could suffer both reduced spreads and leveraged reductions to their book values that may surpass current yields. Nonetheless, until that happens, these agency REITs will continue to occupy some of the highest-yielding space in the market.

Because of the risks associated with agency mREIT leverage and potential peaking of Treasury valuations, exposure to the asset class should be limited to a reasonable percentage of a portfolio, based upon your risk profile, time-horizon, income needs and other investments. Additionally, most REIT dividends are taxed as regular income and not at the lower corporate dividend rate, making them substantially better performing investments when held within tax deferred or exempt accounts.

Disclaimer: This article is intended to be informative and should not be construed as personalized advice, as it does not take into account your specific situation or objectives.

Disclosure: I am long NLY.

conrad murray sentencing urban meyer adam shulman adam shulman nfl power rankings week 13 nfl power rankings week 13 patrice

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.